Welcome to Federal Mortgage News Room

Osidi Inaugurates Performance Management Champions, Demands Responsibility, Exemplary Leadership

Managing Director and Chief Executive of the Federal Mortgage Bank of Nigeria has charged the newly inaugurated Performance Management Champions to demonstrate a high degree of responsibility in the discharge of their duties, urging them to lead by example and inspire others to embrace a growth mindset, set ambitious goals and continuously seek opportunities for learning and development. The charge was given Thursday, May 2, 2024, at the Bank’s head office, when the MD/CE, inaugurated a 12-member team of Champions to drive the entrenchment of a culture of continuous improvement and development towards excellent service delivery by the Bank to Nigerians. It was also a session for sensitization of the Bank’s staff on Employee Performance Management System by the Office of the Head of Civil Service of the Federation (OHCSF). Osidi, harping on the relevance of performance management, stated that “human capital is fundamental to the achievement of the Bank’s strategic goals,” which is why the sensitization and inauguration were held within the first 100 days in office of the new Executive Management Team. "It is in recognition of the imperative for improved service delivery based on performance enhancement, that this management has embedded ‘Enthroning a Robust Organization/Employee Performance Management System’ as the sixth pillar of our 7-point Agenda. This also aligns with the sixth pillar of the Bank’s 5-Year Strategic Blueprint, which is ‘Building High Performing Teams.’ The Chief Executive emphasised that the job of the Champions is not a top-down process, but a collaborative effort. “Each and every one of you plays a vital role in making our performance management system a success. Your feedback, engagement and commitment are instrumental to driving positive outcomes for both individuals and the organization as a whole,” he stressed.

Two officials from the Head of Service, Adetola Akeju and Rikko Omve Owutti, were in attendance to sensitize the Bank’s employees and respond to questions around the New Employee Performance Management System. Mr. Owutti took the staff through an explicit presentation on what the system entails, the rationale, goals, cycle and implementation, noting that President Bola Tinubu directed its institutionalization in all Ministries, Departments and Agencies (MDAs). He urged the Champions to work hard and protect the trust reposed in them by their various departments. “We want to see results. Champions are the eyes in the departments because, work would be cascaded across all departments,” he said. In her comments, the Executive Director, Business Development and Portfolio Management, Chinenye Chinedu Anosike, thanked the officials from the Office of the Head of Service for taking time to sensitize the staff, affirming that performance management places the destiny of the staff in their hands, giving them the liberty to determine how well they perform. Giving the vote of thanks, the Executive Director Finance and Corporate Services, Mr. Ibidapo Odojukan appreciated the team for the clear presentation inspired by futuristic thinking, projecting that the Bank would build a great future through the implementation of the performance management system. The inauguration of the Champions is a pointer to the Bank’s readiness and commitment to implementing the Performance Management System designed to ensure optimised processes across public offices in Nigeria. Signed Dr. J. M. Onyabe Group Head, Corporate Communications

Emir of Lafia Commends, Pronounces Blessings on Osidi, Says New Management Will Exceed Past Successes

Apr. 26, 2024 – The Emir of Lafia, His Royal Highness, Justice Sidi Bage, has praised the Managing Director and Chief Executive of the Federal Mortgage Bank of Nigeria, Shehu Usman Osidi, for his vision and initiatives towards the delivery of the mandate of the Bank. The commendation was given when the Emir paid a courtesy visit to the Bank on Friday, April 26, 2024. Highlighting the purpose of the visit, HRH Bage noted that it was customary to visit sons and daughters of the State who had distinguished themselves in service. “It has been and continues to be our tradition to always visit our children who have been lifted to vantage positions, to see their desk, pray for them and assure them that they have the home support and that we are there with them in the course of their journey. "Very importantly too, we keep track of what they are doing and continue to encourage them to put in their very best in the service of our dear country. Through this tradition, we remind our children that in all they do, they must consider Nigeria first before any other interest and, so far, they have always made us proud," he said. He appreciated the Bank for the reception accorded him and his entourage and the ongoing projects and housing loans to indigenes of Nasarawa State, noting that he was confident that the new Management, led by Osidi, will supersede all past successes of the Bank. He went on to encourage the management team and staff of the Bank to assist the MD/CE, to succeed in the onerous assignment bestowed on him, explaining that as a team, whatever expectations or targets set by the Federal Government is achievable. In his remarks, the MD expressed deep appreciation for the honour, affirming that it is the blessings of Royal Fathers that bring peace. He intimated the Emir on the Bank’s responsibility of managing the National Housing Fund (NHF) and providing mortgages to Nigerians within the medium and low income brackets. Osidi further restated his commitment to effective leadership for top-notch service delivery. “I'd like to reiterate that we’ll continue to do our best to serve the needs of our people, both in Nasarawa State and Nigeria at large,” he said.

Assuring the Emir of their unalloyed support to the MD, the Executive Directors, Finance & Corporate Services, Ibidapo Odojukan and Business Development & Portfolio Management, Chinenye Chinedu Anosike, asserted that they are solidly behind the MD to steer the ship of the Federal Mortgage together and ensure his outstanding success. On his part, the Executive Director, Loans and Mortgage Services, while applauding the staff of the Bank for possessing the qualifications and training to deliver on their tasks, bemoaned the institutional challenges, especially associated with the laws and regulations that established the Bank, which he noted, have clipped the wings of the Bank, preventing it from flying and soaring like the white eagle that it is. He called on the Emir to step in when the need arises for the interpretation of the laws, given his pedigree in the judiciary. He also assured the Emir that they would throw in everything to support the MD to succeed. Remarkably, the Emir, the Executive Director, Loans and Mortgage Services and a member of the Emir’s entourage, Barr. Alh. Muhammad Sani Abbas, had been relating closely for about 45 years and had earned the name “the triangle.” In a goodwill message, Barr. Abbas, who was described as one leg of the triangle, assured Osidi of success, noting that having spent many years with Dr. Abdu, he knows him as one with zero-tolerance for non-performance and would work together with the MD to deliver on the Bank’s mandate. The visit and support from the Emir signifies a significant boost to Osidi to optimally meet the homeownership needs of Nigerians within the medium and low-income brackets. Signed Dr. J. M. Onyabe Group Head, Corporate Communications

Federal Mortgage to Provide N100 Billion for Renewed Hope Cities and Estates Programme

…Relishes Rewarding Partnership with Nigeria Police As part of the strategic drive to support affordable homeownership for Nigerians, the Federal Mortgage Bank of Nigeria will be supporting the 100,000-housing unit Renewed Hope Cities and Estates Programme with N100 Billion in off-taker guarantee. The Managing Director/Chief Executive of the Bank, Shehu Usman Osidi, made the disclosure at the Maiden edition of the Nigeria Police Housing Summit held on Monday, April 22, 2024 at Nicon Luxury Hotel, Abuja. Osidi, who represented the Honourable Minister of Housing and Urban Development, Arc. Ahmed Musa Dangiwa, as Guest of Honour at the Summit, stated that the N100 Billion off-taker guarantee will be provided to the consortium of developers for the project. He added that the N100 Billion is in addition to the Bank’s commitment to provide mortgage loans to the off-takers upon completion of the houses, which will be spread across the nation with prospects of several members of the police force emerging as beneficiaries. The Chief Executive relayed government's frustration at the long term relegation of the issue of police housing, which has resulted in dire consequences for both the officers and the communities they serve, and commended the Inspector General of Police, IGP Kayode Egbetokun, for convening the Summit “with the right set of critical stakeholders, central to resolving the challenge of providing shelter to the rank and file of the Nigeria Police.” Commenting on the theme of the Summit, “Renewed Hope for Police Housing in Nigeria,” he noted that the theme “speaks to the acknowledgement of past challenges, the commitment to overcoming them, and the optimism for a brighter future.” Delivering the Minister's address, he said, “Our police officers are the frontline defenders of law and order, often working tirelessly under challenging conditions. The inadequate housing facilities only aggravate their challenges, impacting their morale, well-being, and ultimately, their effectiveness in ensuring the safety and security of the nation. The MD/CE further reiterated the resolve of the President Bola Ahmed Tinubu-led administration’s Renewed Hope Agenda, to ensuring access to decent and affordable housing to Nigerians, noting that achieving this requires a multifaceted approach, one of which is to leverage on partnerships. “Collaboration is essential in harnessing resources, expertise, and innovative solutions to accelerate the pace of development. Through strategic alliances and creative financing mechanisms, we can overcome the constraints that have hampered progress and deliver tangible results within a reasonable timeframe,” he noted. In this regard, he communicated the Minister's desire to the Nigeria Police Force (NPF) to engage strategically with the Federal Mortgage Bank of Nigeria towards realizing its renewed vision of providing decent, affordable and safe housing for officers and men of the Force. Outlining some of the fruits of previous engagements between the Federal Mortgage and the NPF, having enjoyed a productive relationship since the inception of the National Housing Fund (NHF), he noted that over N2.9 Billion mortgage loans had been disbursed to 807 police beneficiaries. Additionally, N2.1 Billion was disbursed to Police Cooperative Housing Development Company to construct 806 housing units, about N158 Million disbursed to 22 beneficiaries under the Rent-to-Own platform and over N289 Million as Home Renovation Loan to 316 officers. Other initiatives include the funding of ongoing housing projects for the Police Cooperative in various locations of Abia, Adamawa, Ogun, Kaduna and the FCT; the refund of a cumulative sum of over N1.8 Billion to 18,619 retired police officers as well as N3 Billion loan to the Nigeria Police Multi-Purpose Cooperative Society/Nigeria Police Force Property Development and Construction Company Ltd. for the construction of 236 housing units at Goza, Wawa District, Abuja. Osidi, therefore, expressed the Minister's appreciation of the bank's scorecard in addressing the needs of the Nigeria Police on the basis of their contributions to the NHF Scheme, noting that the Bank is a ready partner to engage in the Force’s aspiration to deliver affordable housing to their officers and men. Earlier in his address, IGP Egbetokun, alluding to the essentiality of the Summit, disclosed that “the housing capacity of the Force is about 10-12% of the over 400,000 workforce,” and “due to long years of neglect, the existing and available barracks accommodations are largely unsuitable and incompatible with the 21st century policing architecture that we desire to build.” He noted that the Summit was conceived as a platform to discuss and dilate ideas to actualize their vision of accessible and affordable housing for officers and men of the Nigeria Police and would be held on a yearly basis henceforth. Signed Dr. J. M. Onyabe Group Head, Corporate Communications

Diaspora Mortgage Scheme: Six Continents Ready to Commence, Federal Mortgage, NiDCOM Reveal

…Move Product Launch Date Forward Efforts are intensely underway for the launch of the Diaspora Mortgage Loan Product of the Federal Mortgage Bank of Nigeria and the Nigerians in Diaspora Commission (NiDCOM), with six continents already contacted and ready to commence. In a bid to perfect plans towards a successful launch, the Federal Mortgage and NiDCOM have agreed to move the launch date of the product three months forward. The agreement was arrived at when the Chairman/CEO of NiDCOM, Hon. Dr. Abike Dabiri-Erewa, received the management team of the Federal Mortgage at NiDCOM office in Abuja on Friday, April 19, 2024. Recall that the Minister of Housing and Urban Development, Arc. Ahmed Musa Dangiwa, had on November 14, 2023, launched the Diaspora Mortgage Scheme during the 6th edition of the Nigeria Diaspora Investment Summit (NDIS), with plans to launch the loan product at a later date. Speaking during the meeting, the Managing Director/Chief Executive of the Federal Mortgage, Shehu Usman Osidi, noted that the meeting was important, to seek a common ground and understanding on the impending launch of the product, which was earlier scheduled to commence in February 2024, starting with Canada, the United States, and the United Kingdom. However, in consideration of the recent management changes at the Bank, and in compliance with the recent proclamation and ban on foreign travels by President Bola Ahmed Tinubu, the management of the Federal Mortgage proposed a shift in the date. He acknowledged the critical work being done by NiDCOM on behalf of Nigerians, especially those outside the shores of the country, reassuring of the Bank’s continued support. “The Diaspora Mortgage Loan is a product we take seriously, because we see Nigerians in the diaspora as very strategic not only to their immediate communities but to the Nigerian economy generally,” he said. Reporting the progress of work done by the Bank, the Chief Executive said, “the product concept has been approved by the Board and the remittance /contribution apparatus endorsed by the Central Bank of Nigeria (CBN). The ICT infrastructure has also been established within our Core-banking Application system and is currently undergoing necessary test-run and perfection.” In her response, the NiDCOM Chairman, while congratulating the new management team of the Bank, expressed confidence that with the well-known antecedents of the MD, the Bank will be taken to unimaginable heights. She agreed that the new management needed time to settle down and make adequate preparations before the launch, noting that NiDCOM had held similar thoughts of extending the date. Dabiri-Erewa however advised that the three-month shift be used to perfect the product, while also appealing that the test-run of the product commences, to ensure a seamless implementation. Commenting, the Head, Technological Transfer and Innovation, NiDCOM, Hon. Abdulrahman Terab, affirmed that the three months would allow a perfection of the process at the technical level. Also, in his comment, the Executive Director of Loans and Mortgage Services, Federal Mortgage, Dr. Muhammad Usman Abdu, appreciated the work being done by the NiDCOM Head, describing her as a gift to Nigeria. He also highlighted the fact that both teams are in tandem in thought. The Secretary to the Commission, Engr. Dr. Sule Yakubu Bassey, observed that as a low hanging fruit for national development, NiDCOM was ready to harvest the Diaspora Mortgage Loan product and expand investments in real estate globally. The date extension is an indication of the desire of the two organisations to present a flawless product for the benefit of Nigerians in the Diaspora. Signed Dr. J. M. Onyabe Group Head, Corporate Communications

Housing Reform Task Team Reports Significant Progress in Delivery of Assigned Tasks

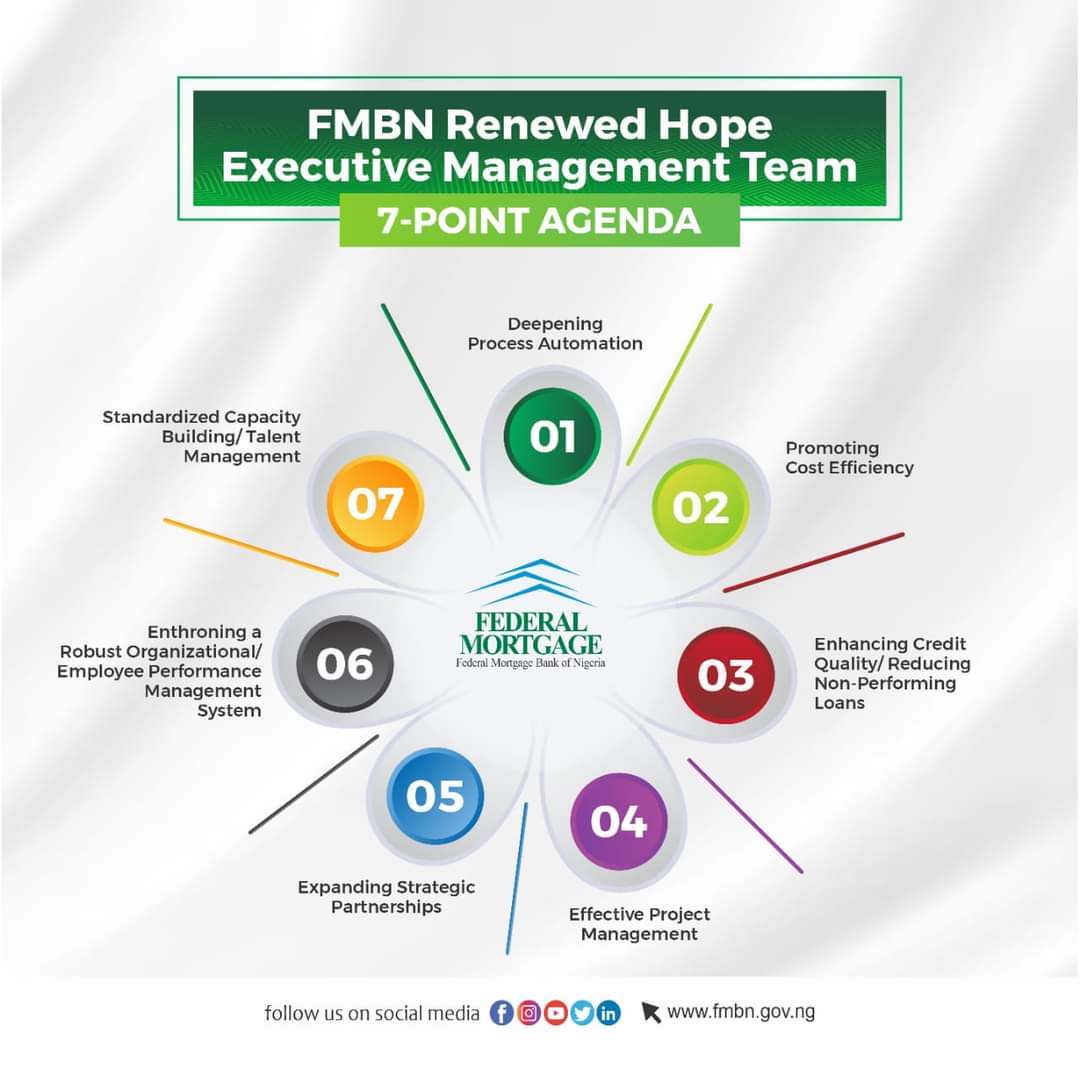

The Minister of Housing and Urban Development, Arc. Ahmed Musa Dangiwa, inaugurated four Housing Reform Task Teams in January 2024, to drive the realization of the Presidential Deliverables for the housing sector, under the President Bola Tinubu-led administration’s Renewed Hope Agenda. Three months later, the Housing Institutions Reform Task Team has reported significant progress in the delivery of its Terms of Reference. The report was presented during a courtesy visit by the Housing Institutions Reform and Multi-Agency Project Delivery Task Teams to the management team of the Federal Mortgage Bank of Nigeria on Wednesday, April 17, 2024. In his welcome remarks, the Managing Director and Chief Executive of the Bank, Shehu Usman Osidi, acknowledged the importance of the responsibility of the Task Teams towards reshaping the landscape of homeownership financing in Nigeria and advancing the goals of affordable housing and urban development. He applauded the visit, describing it as timely, as it presented an opportunity for the Bank and the Reform Task Teams to pool their efforts together and pursue the effective amendments of the FMBN and the NHF Acts already ongoing. He noted that the success of the Task Teams is critical to the success of the Federal Mortgage, given that the onus is on the Bank to actualize the recommendations put forward by the Task Teams. To this end, he revealed that the Bank had commenced a journey of repositioning and recapitalization, in conjunction with the Bureau of Public Enterprises (BPE). “As you may be aware, this Executive Management came in barely two months ago and we have set about conducting the affairs of the Bank methodically. We are concentrating on 7 core but broad agenda to further deepen the ongoing reforms and usher remarkable turnaround,” he stated. Osidi highlighted the 7-point agenda of his team, to include, Deepening Process Automation, Promoting Cost Efficiency, Enhancing Credit Quality/ Reducing Non-Performing Loans, Effective Project Management, Expanding Strategic Partnerships, Enthroning a Robust Organizational/Employee Performance Management System and Standardized Capacity Building/Talent Management. While acknowledging the litany of challenges facing the Bank, particularly the performance of Estate Development Loans, the Chief Executive noted that with the Bank’s 5-Year Strategy Blueprint and the near-completion of the Core Banking Application, service delivery will be improved and process efficiency enthroned. Osidi further appreciated the Minister of Housing and Urban Development for assembling the teams to spearhead the crucial reform efforts of housing institutions under the Ministry and thanked the team members for their dedication, expertise and commitment to the assigned tasks. Presenting the report of the Housing Institutions Reform Task Team, the Chairman, Adedeji Jones Adesemoye, highlighted the terms of reference of the team, and identified the challenges and recommendations drawn out by the team for each of the deliverables towards affordable housing for all Nigerians. He elaborated on the strides already taken by the team with regard to the plans towards the Bank’s recapitalization and amendments of the FMBN and NHF Acts, with a view to repositioning the Federal Mortgage as a global reference point in Mortgage financing. Also speaking, the Chairman of the Multi-Agency Project Delivery Task Team, Brig. Gen. P.M. Tunde Reis (rtd), represented by Arc. Chioma Wogu-Ogbonna, while outlining the responsibilities of the team, pledged the team’s commitment to eliminate the bottlenecks in housing delivery financing. She applauded the Bank’s initiative of digitalizing the Bank, noting that it is long overdue. In his comment, the Executive Director, Loans and Mortgage Services, Dr. Muhammad Sani Abdu, advised that all finalized reports by the teams should be compiled and presented to the general public to get their buy-in for the initiatives. The Executive Director, Finance and Corporate Services, Mr. Ibidapo Odojukan, appreciated the level of work already done by the teams towards revitalizing the Federal Mortgage. On her part, Executive Director, Business Development and Portfolio Management, Mrs. Chinenye Chinedu Anosike, also praised the work done so far by the team and expressed optimism about the growth of the Bank and the housing sector. Signed Dr. J. M. Onyabe Group Head, Corporate Communications

Osidi Charges REDAN on Responsibility, Mulls Project Management Training for Developers

The Managing Director/Chief Executive of the Federal Mortgage, Shehu Usman Osidi, has charged Estate Developers under the aegis of the Real Estate Developers Association of Nigeria (REDAN), to exhibit a high sense of responsibility in their business engagements. Osidi gave the charge when the leadership of REDAN paid a courtesy visit to the management team of the Federal Mortgage at the Bank’s headquarters on Thursday, April 4, 2024, to deepen the existing partnership between the Bank and REDAN. In his address, the Chief Executive, congratulated the new President of REDAN, Prince Akintoye Adeoye, describing him as patient and mature. He commended his dexterity, patience and resilience, adding that he is a man ready for the job. Osidi noted that the new management team of the Federal Mortgage is poised to expand strategic partnerships as one of the key items on the Team’s 7-point Agenda, which makes the visit of REDAN timely. He enunciated the commitment of the Bank’s new management team to the sustenance of the existing mutually beneficial business relationship with REDAN, urging the association to be positioned to make the Bank proud. In this regard, Osidi pledged to carry REDAN along in the execution of three key areas of the 7-point agenda, namely, standardized capacity building/talent management, expanding strategic partnerships and enhancing credit quality/reducing non-performing loans. He explained that the Federal Mortgage will partner with REDAN to build the capacity of its members on project management, while also working with them to categorise Estate non-performing loans, with a view to reduce them. He however cautioned that it will no longer be business as usual, and urged the association to work hard to be a child the Bank would be proud of.

Prince Adeoye congratulated the new management of the Federal Mortgage on their appointment and praised the Bank for its instrumentality in the formation of REDAN. He stated that the assignment before Osidi is huge, but alluding to the 7-point Agenda of the Team, affirmed that the MD is capable of delivering on all the objectives of the bank. He therefore called for a strengthened partnership between the Bank and REDAN in the areas of capacity building and reduction of non-performing loans, while seeking the Bank’s support in passing a bill to regulate the activities of developers in the country. In his remark, the Executive Director, Loans and Mortgage Services, Hon. Dr. Muhammad Sani Abdu, acknowledged REDAN’s maturity and readiness for business, while the Executive Director, Business Development and Portfolio Management, Chinenye Chinedu Anosike, expressed optimism of a better working relationship with REDAN. On his part, the Executive Director, Finance and Corporate Services, Mr. Ibidapo Odojukan, welcomed REDAN’s readiness to improve, affirming that it is an indication of the association’s inclination to strengthen its partnership with the Federal Mortgage. The visit also presented an opportunity for the Chairman, Investiture Committee of REDAN President, Dr. Roland Igbinoba, to remind the Management Team of the upcoming investiture ceremony of the REDAN President slated for May 23, 2024 in Lagos. Signed Dr. J. M. Onyabe Group Head, Corporate Communications

Federal Mortgage, Kaduna State University to Partner on Affordable Housing

In response to the challenge of housing deficit facing staff of the Kaduna State University and Nigerians at large, the Management of the Federal Mortgage Bank of Nigeria is considering a collaboration with the Kaduna State University for a mass housing project. The plan was revealed when the Bank’s Management played host to a delegation from the Kaduna State University, on Thursday, April 4, 2024 at the Bank's head office in Abuja. The Kaduna State University chapter of the Academic Staff Union of Universities (ASUU) had earlier submitted a proposal to the Federal Mortgage for the Academia Housing Project for staff of the University, outlining the importance of the project. Commending the Kaduna State University Team for the thoughtfulness in innovating ways of addressing the housing challenge facing the Academia in Kaduna State, the Managing Director/Chief Executive of the Bank, Shehu Usman Osidi, assured them that the Management Team would promptly look at their proposal, and following compliance with application requirements, grant approval. Osidi further hailed the University’s initiative of a skills development programme for the students as well as the ‘waste to wealth initiative', noting their exigency and timeliness.

Speaking during the visit, the leader of the KASU delegation, Dr. Abubakar Abdullah, highlighted the benefits of the proposed housing project to the Academic community, the state and the nation at large. He explained that the Team had come in search of a solution to the housing crisis facing staff of the institution. Dr. Abdullah, who is the Vice Chairman, Kaduna chapter of ASUU, and the Coordinator of the Academia Housing Project, noted that the project, while addressing the housing challenge, would also develop a mechanism for converting household waste to gas for household use. He further stated that through the project, a skills acquisition programme would be launched to equip students with technical skills for survival upon graduating. He added that the students would learn screeding and fabrication of doors and windows, aimed at curbing the prevailing unemployment in the country. Dr. Abdullah thanked the Management of the Federal Mortgage for the promise to fast track the partnership process, considering the project delivery timeline of December 2024. Signed Dr. J.M. Onyabe Group Head, Corporate Communications

FMBN Interfaces with Kano State Advisory Committee on Participation of Civil Servants in NHF Scheme

Last week, the Executive Management of the Federal Mortgage Bank of Nigeria, led by the Managing Director/Chief Executive, Shehu Usman Osidi, met with the Kano State Advisory Committee on Participation of Civil Servants in the National Housing Fund (NHF) Scheme, at the Bank’s Headquarters. The 8-man delegation from Kano State, led by the Special Adviser to the Governor on Civil Service Matters, Dr. Suleiman Wali Sani, visited the Bank to interface with its Management on the participation of Kano State civil servants in the NHF Scheme. The Chairman of the Nigeria Labour Congress (NLC), Kano Chapter, Comrade Kabiru Inuwa was also part of the team. The deliberations were fruitful as the Kano delegation went home with a single goal in mind: To get all civil servants in Kano State to enroll into the NHF Scheme to enjoy the benefits that accrue to contributors. Here are some sights from the meeting…

I Expect You to Do Ten Times More than I Did, Minister Challenges New FMBN Management Team

Minister of Housing and Urban Development, Arc. Ahmed Musa Dangiwa has charged the newly appointed Executive Management Team of the Federal Mortgage Bank of Nigeria (FMBN) to exceed the achievements he recorded during his time as Managing Director, to deliver more decent and affordable houses to Nigerians. The Minister gave the charge during a meeting with the new Management Teams of the FMBN and Federal Housing Authority (FHA) at the headquarters of the Federal Ministry of Housing and Urban Development on Thursday, February 22, 2024. The meeting was convened on the heels of the recent change of leadership in the housing agencies under the Ministry, namely FMBN and FHA. President Tinubu had, on February 15, approved the appointment of Mr. Shehu Usman Osidi as Managing Director/Chief Executive of the FMBN, Mr. Ibidapo Odojukan as Executive Director, Finance & Corporate Services; Mr. Muhammad Sani Abdu as the Executive Director, Loans and Mortgage Services; and Mrs. Chinenye Chinedu Anosike as Executive Director, Business Development and Portfolio Management. Acknowledging the criticality of the FMBN to the actualisation of the Renewed Hope Vision for Housing, the Minister urged the Team to approach their work with the urgency required, so as to boost the economy, create jobs, contribute to the GDP, and bolster productivity. He urged the Team towards performance, stating that “You will be seeing a lot of pressure from me. This is because I expect you to do ten times better than I did.” He called on the Bank to be strategically positioned to deliver. “What this means is that FMBN must transform. FMBN must innovate. And FMBN must lead a new era of massive housing development and delivery, even in these difficult times of high construction costs and lower incomes. This requires a radically new mindset, thinking out of the box and identifying the opportunities that these challenges present,” he said. While recognizing some fundamental challenges the Bank is facing at the moment, Arc. Dangiwa pledged his full support and guidance in navigating through the challenges, and outlined some of the steps already being taken to clear the path for the Bank’s successful operations. Dangiwa, who tagged the new Management Teams of the two agencies as “Renewed Hope Executive Management Teams of Federal Housing Agencies”, emphasized that they must fashion out ways to deliver on the key deliverables of the housing sector set by the President. “If you work hard and deliver, you will stay. If you don’t work hard and fail to deliver, you will leave before your term. I believe that is a strong message that Mr President has already passed across to all appointees,” he stressed. Responding on behalf of the Executive Management of the FMBN, the Chief Executive, Mr. Osidi, appreciated the President and the Minister for counting them worthy of serving the nation as the Executive Management of FMBN. He pledged their commitment to uphold the confidence bestowed on them by President Tinubu, through the appointments. He reassured the Honourable Minister that they understand that their job is cut out for them and promised to work with his Team to take the FMBN to greater heights, in line with the Renewed Hope Agenda for the housing sector. While reiterating his commitment to an open, transparent and accountable administration, he appealed to the Minister not to grow weary of the Bank’s constant knocks on his door for guidance and support. Signed Mrs. Timan Elayo Group Head, Corporate Communications

FMBN and Shelter Afrique Deepen Collaboration Towards Decent and Affordable Housing Delivery

As part of efforts to mobilise resources towards meeting the housing needs of Nigerians, the Managing Director/Chief Executive of the Federal Mortgage Bank of Nigeria (FMBN), Mr. Shehu Usman Osidi has expressed the Bank’s readiness to partner with Shelter Afrique Development Bank, a foremost Pan-African housing finance institution. The agreement was reached during a meeting between the two institutions at the Board Room of the Bank's Head Office, on Thursday, February 22, 2024. The meeting was convened at the instance of the Honourable Minister of Housing and Urban Development, Arc. Ahmed Musa Dangiwa, in fulfillment of his commitment to “being a Way Maker, a Facilitator, and a Catalyst for the transformation of the FMBN into a modern, impactful and resilient housing finance institution that delivers on the maxim, “Everyone Deserves a Home.” Presenting the various product offerings of Shelter Afrique, the Chief Executive Officer, Mr. Thierno-Habib Hann, outlined four categories that could benefit the FMBN in the delivery of its mandate, namely, the Financial Institutions Group, the Project Finance Group, the Sovereign and Public Private Partnership Group and the Fund Management Group. He acknowledged the key role played by Nigeria in reducing the 52 million housing deficit facing the African continent, noting that Nigeria is the second largest shareholder of the Bank, with 15.2% shares, slightly lower than Kenya which leads with 16%. Mr. Hann appreciated the contributions of the Honourable Minister to the transformation of Shelter Afrique to the stautus of a Development Bank and for facilitating the various collaborative efforts, including the one with the FMBN, an indication of his deep commitment to the transformation of the housing sector in Nigeria and Africa. On his part, the Managing Director/Chief Executive of FMBN appreciated the Shelter Afrique Team for the visit, noting that the housing sector in Africa has the right people in place. He stated the FMBN’s readiness to take advantage of the partnership in the areas of construction finance and infrastructure finance to complete some abandoned projects in States, and also for the Diaspora Mortgage Scheme. “We have a large pool of contributors to the National Housing Fund (NHF) so, we can quickly profile and specifically discuss projects. While they can access funding from Shelter Afrique, we can provide the guarantees,” he noted. Mr. Osidi further explained that the partnership will enhance the implementation of the recently launched Renewed Hope Cities and Estates Programme. “Under the Renewed Hope Cities and Estates Programme of the Federal Government, FMBN is providing the off-take guarantee for the development of 100,000 housing units across the country. We will be happy to engage with you on how to scale up those kinds of opportunities through your construction finance.” Additionally, the Executive Director, Finance and Corporate Services, Mr. Ibidapo Odojukan, noted that other products the two institutions could collaborate on included the Student Housing Scheme, Project Preparation Fund and Mortgage Refinancing products of Shelter Afrique. The Group Head, Project Finance, Dr. Kabir A. Yagboyaju also noted some low- hanging fruits among the products that the FMBN could take advantage of, to include the Green facility, projects targeting gender (women) and the development of an instrument for project financing. To fast-track the partnership initiatives, the meeting resolved to set up a Technical Committee to draw up the next steps for the collaboration, with a commitment to commence deliberations immediately. The meeting was attended by the Chairperson of the Board of Shelter Afrique, Dr. Chi Akporji, the Chief Executive of Shelter Afrique, Mr. Hann, a Director of the Board of Shelter Afrique, Eucharia Alozie, Regional Representative, Anglophone West Africa, Elizabeth Ogonegbu, representative of the Honourable Minister, Dr. Akinola Olakunle, and other representatives from the Ministry of Housing and Urban Development and top Management staff of the FMBN. Signed Mrs. Timan Elayo Group Head, Corporate Communications

FMBN Open to Collaboration with State Govts for Affordable Housing Delivery Monday, March 11, 2024.

The Managing Director/Chief Executive of the Federal Mortgage Bank of Nigeria, Shehu Usman Osidi, has restated the Bank's commitment and readiness to strengthen partnerships with state governments across the Federation, to bolster affordable housing delivery. Osidi stated this in his goodwill message at the Commissioning (Phase 1) and Ground-Breaking Ceremony (Phase 2) of Nasarawa Technology Village in Aso Pada District, Karu, Nasarawa State, on Monday, March 11, 2024. Applauding the project, the MD/CE congratulated the Visioner of the project and the Executive Governor of Nasarawa State, Engr. Abdullahi A. Sule, as well as the Developers, ABS Blueprint Limited, Modern Shelter System and Services Limited and Statewide Home Builders Limited Consortium, for prompt delivery of the project. Osidi noted that the housing units stand as a testament to collective progress in tackling the housing shortage facing Nigeria. He said, "The Federal Mortgage Bank of Nigeria is proud to be associated with this event and we are delighted at the significant impact this project is bound to make in our journey towards providing sustainable housing solutions and fostering development within our communities." He further highlighted key collaborative efforts already undertaken by the Bank towards improved access to decent and secure accommodation for Nigerians at all levels of income brackets through affordable mortgage financing. Focusing on Nasarawa State, Osidi revealed that the Bank has financed 11 housing projects, with a record 7,886 Nasarawa State indigenes as beneficiaries of the Bank's Home Renovation Loan (HRL) window. Additionally, he stated that within a few weeks, Gov. Sule will be commissioning 150 units of houses developed by Alphabait Realty Limited and funded by the Bank. Osidi therefore harped on the need to continue leveraging on innovation and strategic partnerships to drive affordable housing delivery, with a promise of expanded homeownership across all States when the Bank is recapitalised, "as is being actively championed by the Honourable Minister of Housing and Urban Development, Arc. Ahmed Musa Dangiwa." The FMBN Chief Executive, while calling on other State Governments to take advantage of the partnership offer to address the housing needs in their states, encouraged Nasarawa State indigenes to make efforts to access the homeownership opportunities made available by the Bank, in the form of Home Renovation Loans, Individual Construction Loans, and Cooperative Housing Development Loans, amongst others. Signed Mrs. Timan Elayo Group Head, Corporate Communications

FMBN Mulls Partnership with Turkish Investors on Affordable Housing Delivery - 12th March 2024

In a bid to make building materials affordable and accessible towards the democratization of homeownership as envisioned by the Renewed Hope Agenda of President Bola Ahmed Tinubu for the housing sector, plans are underway for a robust partnership between the Federal Mortgage Bank of Nigeria (FMBN) and NG Kutahya Seramik, a leading Turkish ceramic production company. The plans were made known by the Managing Director and Chief Executive of the Bank, Shehu Usman Osidi, during a recent courtesy visit by the NG Kutahya Seramik team to the FMBN Management. Emphasizing the significance of such collaborations to the operations of the Bank, Osidi enunciated the Bank’s readiness to provide the enabling environment for the ceramics company to thrive. He said, “We have land in Nigeria and the new government is in the process of establishing the Building Materials Manufacturing Hub in each of the six geopolitical zones of the country, championed by the Ministry of Housing and Urban Development under the leadership of the Honourable Minister, Arc. Ahmed Musa Dangiwa.” “We are willing to provide the enabling environment in terms of land space and choice of actual location for your projects,” he stated. Recent reports from the built environment indicate that Nigeria is battling high cost of building materials, with its attendant impact on housing supply in the country. While the Housing Minister has undertaken key steps to improve the trend, he recently voiced out the fact that the situation is capable of exacerbating the housing deficit crisis in the country. The partnership, when actualised, will bring relief to developers by lowering building costs. The MD/CE further noted that the Government is working towards enhancing local production, which requires huge capital, skills and expertise. He urged the Turkish investors to take advantage of the opportunity for their benefit and that of Nigeria and Nigerians. In a presentation, the Export Director of NG Kutahya Seramik, Mr. Burcin Yolasan, introduced the Company as a pioneer of the world ceramic industry, with innovative dimensions and designs, which create the difference. Mr. Yolasan outlined the Company’s product range to include glazed porcelain ceramics, floor and wall ceramics, slabs, UV panels, PVD coated ceramics, double charge and new generation anti-slip tiles. He added that the partnership will not only have Nigeria as a consumer of the products but as a producer. He noted that while making Nigeria a sales point, the partnership will also grow the gross domestic product in terms of taxes and export duties. Executive Director, Finance and Corporate Services, Mr. Ibidapo Odojukan and Executive Director, Loans and Mortgages, Dr. Muhammad Sani Abdu, welcomed the partnership, noting that Nigeria has the necessary resources to drive the initiative and the Bank is strategically placed to maximally catalyse the process. Signed Mrs. Timan Elayo Group Head, Corporate Communications

Housing Delivery: FMBN to Consolidate Partnership with COPEN, AG Mortgage

Housing Delivery: FMBN to Consolidate Partnership with COPEN, AG Mortgage Cognizant of the integral place of collaboration in addressing the housing deficit in Nigeria, the Federal Mortgage Bank of Nigeria (FMBN) has taken progressive steps in seeking new partnerships and collaboration while enhancing existing ones with like-minded organisations. This was the focus of a meeting held on Tuesday March 12, 2024, between the Bank and the Management Teams of Copen Services Ltd. and AG Mortgage Bank Plc. The two groups were on a courtesy visit to solidify their existing partnership with the Bank, following the emergence of a new Managing Director and Chief Executive at FMBN. Speaking during the visit, the Managing Director and Chief Executive of FMBN, Shehu Usman Osidi, pledged the readiness of the Bank to engage constructively with the visiting organisations for a mutually beneficial relationship. He appreciated the hand of fellowship extended to the Bank and assured them of working together to devise ways of achieving progress in the housing industry. The Executive Directors of the Bank hailed the step taken by COPEN Services and AG Mortgage to continue the partnership with the Bank. The Executive Director, Loans and Mortgages, Dr. Muhammad Sani Abdu, highlighted the need to re-invent the housing and mortgage industry to enable the provision of qualitative housing for Nigerians, focusing on three major areas of housing delivery, namely collaboration/collective efforts, affordability, which entails creating houses that are affordable for those at the bottom of the pyramid of society; and to envision housing as a process, rather than as a product. COPEN Services, led by its MD/CEO Rev. Dr. Ugochukwu Chime, has a long-standing partnership of 22 years with the Bank, while AG Mortgage Bank, led by Mr. Ngozi Onyemuwa Anyogu, has partnered with the Bank for 19 years, prompting the FMBN Chief to describe them as “partners in progress. The visitors congratulated the new Management Team of FMBN and expressed their confidence in the quality of the Team to deliver on the many expectations for housing delivery. They further pledged their unalloyed support to the Bank in its efforts to deliver on its mandate. Signed Mrs. Timan Elayo Group Head, Corporate Communications

Leverage on ICT for Efficient Implementation of FMBN 5-Year Strategic Blueprint, MD Charges Staff

Leverage on ICT for Efficient Implementation of FMBN 5-Year Strategic Blueprint, MD Charges Staff The Managing Director/Chief Executive (MD/CE) of the Federal Mortgage Bank of Nigeria (FMBN), Shehu Usman Osidi, has charged staff of the Bank to leverage on the full potentials of Information and Communication Technology (ICT), to enhance efficiency, collaboration and implementation of the FMBN 5-Year Strategic Blueprint. Osidi stated this while declaring open a Retreat recently organised by the Strategy Project Management Office (SPMO) of the Bank at Pearl Hotel, Jabi, Abuja. The SPMO is responsible for midwifing the delivery and implementation of the FMBN 5-Year Strategic Blueprint (2022 - 2026). Speaking on the importance of the Retreat, the MD/CE said it was pivotal, especially as it was taking place shortly after the assumption of office of a new Executive Management Team led by him. He called on the participants to play critical roles, both individually and collectively, as members of the SPMO, in shaping a greater part of the future of FMBN. He challenged them to be consistently conscious about the intent and focus of the Retreat, which was put together to help them imbibe the skills and knowledge critical to seamless strategy execution. "We must be deliberate in executing whatever strategic intents we have committed ourselves to implementing. Accordingly, all our endeavours need to flow from the Strategy Blueprint, particularly our annual budgets and work plans, across all facets of the organisation. "We must toe the line that we have designed for ourselves – whether it is the reduction of NPLs, diversification of product offerings, collection targets or employee productivity," he said. Osidi further noted that the implementation of the Strategic Blueprint would be achieved if the Bank leverages on the use of ICT, not only in its strategy project management endeavours, but across its work processes and product platforms. Highlighting the key focus of the Retreat; Organisational Culture Change, Green Building Practices and Sustainability and Technology, Osidi noted that the Bank must also be conscious of climate change and sustainability, and be ready for the necessary shift towards eco-friendly practices and building structures, as well as clean energy, to demonstrate its commitment to the environment and safeguard the lives of future generations. "This must be a major consideration in the projects we are financing," he added. He reassured staff of the commitment of Management to support the efficient delivery of assigned tasks, stressing that while Management would reward diligence, it would equally reprimand indolence, and have zero tolerance for complacency. Also speaking, the Executive Director, Loans and Mortgages, Dr. Muhammad Sani Abdu, hailed the FMBN workforce as a collection of excellent, well-trained persons. He harped on the need to value everyone and advised the staff to embrace the mantra of “have done” rather than “will do.” The Executive Director, Business Development and Portfolio Management, Mrs. Chinenye Chinedu Anosike, urged participants to ensure the thorough execution of all the strategies and resolutions reached during the Retreat, towards moving the Bank forward. Similarly, the Executive Director, Finance and Corporate Services, Mr. Ibidapo Odojukan, drawing strength from the saying, “Culture eats strategy for breakfast,” urged the staff to re-orientate and re-energise the culture of execution. Signed Mrs. Timan Elayo Group Head, Corporate Communications

FMBN to Developers: Prioritize Quality, Habitability of Project Sites

FMBN to Developers: Prioritize Quality, Habitability of Project Sites Sequel to the Commissioning of Phase 1 of Nasarawa Technology Village, the Federal Mortgage Bank of Nigeria (FMBN) has urged Developers of the Project to ensure that the environment is fit for habitation and delivered within stipulated timelines. The call was made when the Bank met with the Project Developers comprising of Modern Shelter Systems & Services Ltd, ABS Blueprint Ltd and Statewide Home Builders Ltd, at the Bank's Headquarters in Abuja. Speaking during the meeting, the Managing Director/Chief Executive of the Bank, Shehu Usman Osidi, gave the Developers a pat on the back for the capacity to attract such huge funding, to the tune of N12 billion and for quality and timely delivery of the Project. “It is quite commendable for private developers like you to access funding from Shelter AFrique, but more commendable is your ability to attract such a large sum, considering the prevailing bottlenecks in accessing funding.” While commending the Developers, Osidi expressed the Bank’s readiness to provide offtake services for the Project. He noted that the Bank will support the profiling of offtakers, spelling out the need for the Developers to draw up a framework for upgrading the Project to a proper mortgage. He added that it is not enough to build houses but to ensure that people actually take the houses and live in them. Corroborating the point made by the MD, the Executive Director, Loans & Mortgages, Dr. Muhammad Sani Abdu, commended the Developers for the number and quality of houses built, and urged them to do due diligence to ensure that the Project environment is fit for immediate occupancy. He explained that the road network, electricity and other relevant infrastructure should be done in a timely manner. On his part, the Executive Director, Finance & Corporate Services, Mr. Ibidapo Odojukan and the Executive Director, Business Development & Portfolio Management, Mrs. Chinenye Chinedu Anosike also reaffirmed the Bank’s readiness for strategic partnership with serious-minded Developers. Earlier in his presentation, Managing Director of Modern Shelter Systems & Services Ltd, Mr. Abdulmalik Mahdi, elaborated on the Project, noting that they had developed 67 hectares of land (1400 housing units) in partnership with the Nasarawa State Government. He highlighted the challenges of offtaker affordability of monthly mortgage payment and sought the intervention of the new FMBN management in tackling the challenges and for the development of Mega Cities/Housing Schemes. He received assurances of the Bank's MD for the removal of all bottlenecks to mortgage transactions. Signed Mrs. Timan Elayo Group Head, Corporate Communications

New FMBN Executive Management Team Unveils 7-Point Agenda, Vows to Transform Bank

New FMBN Executive Management Team Unveils 7-Point Agenda, Vows to Transform Bank To fully realize the potentials of the Federal Mortgage Bank of Nigeria (FMBN) as the foremost Mortgage Institution in Nigeria, the new Executive Management Team of the Bank, has made public its plan of action for running the Bank. The Managing Director and Chief Executive of the Bank, Shehu Usman Osidi, unveiled his Team’s 7-Point Agenda for taking the Bank to greater heights, during a town hall meeting with the staff of the Bank, on Tuesday, March 19, 2024. The 7-Point Agenda borders on Deepening Process Automation, Promoting Cost Efficiency, Enhancing Credit Quality/ Reducing Non-Performing Loans, Effective Project Management, Expanding Strategic Partnerships, Enthroning a Robust Organizational/Employee Performance Management System and Standardized Capacity Building/ Talent Management. Osidi explained that the 7-Point Agenda encapsulates the guiding principles that form the core of the Management Team’s drive at turning around the fortunes of the Bank for good. He noted that the Management Team would recalibrate the FMBN automation process to fully exploit all that technology can offer across all job functions, to promote efficiency and effectiveness, as well as transform the Bank’s corporate image across generations. To effectively implement the agenda and elicit the desired result, the Chief Executive re-echoed the Management Team’s resolve to challenge the status quo. He said, “In doing this, as I have said severally, we will challenge the status quo and the way we do things, not just for the fun of it, but to turn things around positively. This is why I believe from the onset, that we must be focused, deliberate and very clear about the goals we must pursue and the path we must take.” Osidi further stated that “As a Team, this Executive Management desires to transform FMBN into an Institution that we will all be proud of and one that will be a great place to work for young, aspiring professionals; an institution that we can look at with pride even when you leave the system; an institution that will impact positively on the welfare and lives of staff that have made the journey possible.” “We want to build a system that encourages initiatives and innovation; a system that rewards you for outstanding contributions as well as holds you responsible and accountable for decisions you have taken that impact the Institution,” he added. He urged all the Staff to team up with the new Executive Management Team for the implementation of the laudable programs, reassuring that Management will pursue goals, only to the extent that such goals will contribute to the achievement of the collective aspirations of the Bank. Signed Mrs. Timan Elayo Group Head, Corporate Communications

7-point Agenda of the newly inaugurated FMBN Executive Management Team

The newly-unveiled 7-point Agenda of our Executive Management Team forms a roadmap and a set of guiding principles for what is required to achieve efficient service delivery in the provision of decent, quality, and affordable housing to Nigerians

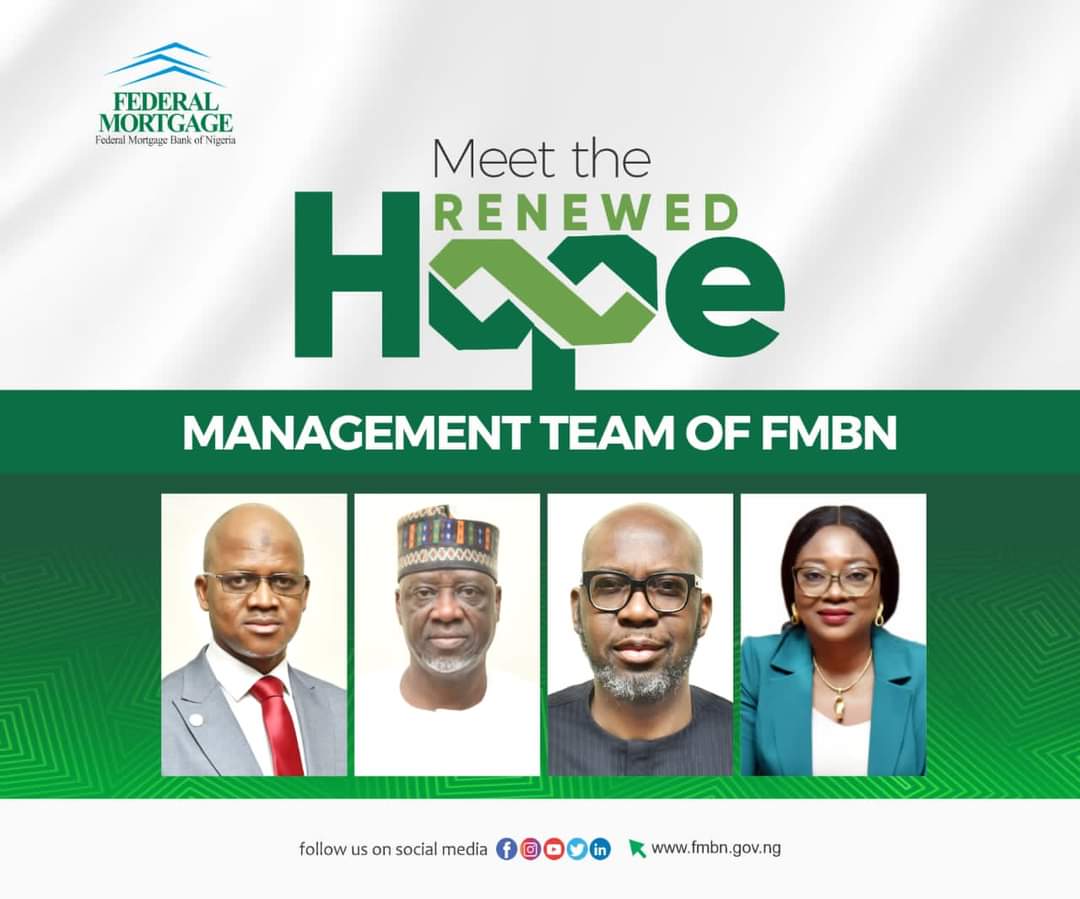

Our Renewed Hope Management Team

The Managing Director and Chief Executive, Shehu Usman Osidi, is poised to deliver on the mandate of the bank in line with the Renewed Hope Agenda for Housing and Urban Development as envisioned by President Bola Ahmed Tinubu, GCFR.

Our Renewed Hope Management Team

Our Renewed Hope Management Team led by Mr. Shehu Usman Osidi

"I am Committed to Running an Open, Transparent and Accountable Administration" – Shehu Osidi

Mr. Osidi stated this during a Handover Ceremony held on Monday, February 19, 2024, at the Board Room of the Bank’s Head Office, as he took over from Mr. Madu Hamman, who steered the affairs of the Bank since April 2022, when he was appointed Managing Director/Chief Executive. Reminiscing on his previous stint at the FMBN, the new MD noted that it was a homecoming for him, having served the Bank for 13 years before leaving for another assignment. He thanked the outgoing Management Team for their selfless service, commending them for doing remarkably well during their tenure. Mr. Osidi further expressed appreciation to President Tinubu and the Honourable Minister of Housing and Urban Development, Arc. Ahmed Musa Dangiwa, for giving him and the incoming Executive Directors the opportunity to serve Nigerians in the provision of affordable housing solutions. Other newly appointed Executives are Mr. Ibidapo Odojukan, Executive Director, Finance and Corporate Services, Mr. Muhammad Sani Abdu, Executive Director, Loans and Mortgage Services and Ms. Chinenye Anosike, Executive Director, Business Development and Portfolio Management. Osidi revealed that the new executives boast of many years of expertise in banking and other sectors and embody the perfect blend of technical expertise needed to move the institution forward. While acknowledging the myriad challenges facing the housing sector, he assured of his readiness to hit the ground running, urging the Senior Management of the Bank and other staff to embrace teamwork, for the actualization of the Bank’s vision, which is linked to the Renewed Hope vision for the Housing Sector. Presenting the handover notes, Mr. Hamman brought the new Executives up to speed on the Bank’s ongoing initiatives and engagements, urging them to consolidate on the efforts of the outgoing Executives, made up of himself as MD/CE, Mrs. Zubaida Umar as Executive Director, Finance and Corporate Services, Dr. Lukman Mustapha as Executive Director, Loans and Mortgage Services and Mr. Kingsley Chukwuma as Executive Director, Business Development and Portfolio Management. He thanked President Tinubu for the opportunity to serve and congratulated the new Management, challenging them to think deep and come up with innovative ways to mobilize resources to meet the enormous housing demand of Nigerians. He expressed confidence in the growth and development of the FMBN, emphasizing that “with Mr. Osidi’s proven track record of performance, I am confident that the Bank is in very capable hands. The future of mortgage banking is very bright with the new Team on board,” he said. The Handover Ceremony evoked varying emotions, as the Senior Management Team members took turns to both appreciate the outgone Team members for their service to the Bank and to pledge their support to the new Team members, in their effort to propel the Bank to greater heights. Signed Mrs Timan Elayo Group Head, Corporate Communications

Shehu Osidi Takes Over as MD, as President Tinubu Appoints New Executives for FMBN

Shehu Osidi Takes Over as MD, as President Tinubu Appoints New Executives for FMBN Pursuant to the need to strategically reposition the Federal Mortgage Bank of Nigeria (FMBN) to drive the actualization of the Renewed Hope Agenda for the Nigerian housing sector, President Bola Ahmed Tinubu on Thursday, February 15, 2024, approved the appointment of Mr. Shehu Usman Osidi as the new Managing Director and Chief Executive of the Bank. According to a Press release by the Special Adviser to the President on Media and Publicity, Chief Ajuri Ngelale, the move is to meet the present and future needs of Nigerians. The release reads in part: “As part of a holistic approach to repositioning the national housing and urban development sector to meet the present and future needs of Nigerian families nationwide, President Bola Tinubu has approved the reconstitution of the Executive Management Teams of parastatals under the Federal Ministry of Housing and Urban Development.” President Tinubu also approved the appointment of Mr. Ibidapo Odojukan as the Executive Director, Finance & Corporate Services, Mr. Muhammad Sani Abdu as the Executive Director, Loans and Mortgage Services and Ms. Chinenye Anosike, Executive Director, Business Development and Portfolio Management. The new Managing Director/Chief Executive, Mr. Osidi takes over from Mr. Madu Hamman who held the reins of the FMBN from April 2022, when he stepped into the shoes of the current Minister of Housing and Urban Development, Arc. Ahmed Musa Dangiwa, till yesterday, February 15, 2024. These appointments are coming barely a week after the Minister charged the Bank’s Management at the FMBN 2024 Annual Retreat, to innovate and lead the new era of massive housing development initiatives of President Tinubu. The new FMBN CE, Mr. Shehu Osidi, is a consummate banker with over 30 years of banking experience, during which he worked as Branch Manager/Head of Marketing in four (4) different commercial banks, namely; Lion Bank of Nigeria Plc (1990 to 2005); Diamond Bank Plc (2005 to 2006); Intercontinental Bank Plc (2006 to 2007) and Afribank Nigeria Plc (2007 to 2010), before taking up an appointment as an Assistant General Manager (AGM) with the Federal Mortgage Bank of Nigeria (FMBN) in April 2010. He voluntarily retired on 4th September 2023 as a General Manager (GM), after 13 years of meritorious service to the Bank, following his appointment as Special Adviser on Housing and Chief of Staff to the Honourable Minister of Housing & Urban Development. Remarkably, Osidi makes history as the first staff of the Bank to be appointed as its MD/CE, an attestation to his outstanding leadership qualities and performance. While at the FMBN, he introduced quite a number of innovative initiatives to propel the Bank to excellence, including being the brain behind the FMBN’s Home Renovation, Rent-to-Own and the Nigerians in the Diaspora NHF Mortgage loan products. Osidi is an Associate Member of the Chartered Institute of Personnel Management of Nigeria (ACIPM); a full Member of the Nigerian Institute of Management (MNIM), an Honorary Senior Member of the Chartered Institute of Bankers of Nigeria (HCIB); a Fellow of the Institute of Credit Administration (FICA) and a Certified National Accountant (CNA). He is an alumnus of the prestigious Harvard Kennedy School of Government, Harvard University, Boston, USA, as well as the Wharton School, University of Pennsylvania, USA and has attended several courses both locally and internationally. As a testament to his unmatched capacity in the banking sector, he has won several awards, including the Most Outstanding Branch Manager for Abuja Region in 2009 while at Afribank Plc. Signed Mrs Timan Elayo Group Head, Corporate Communications